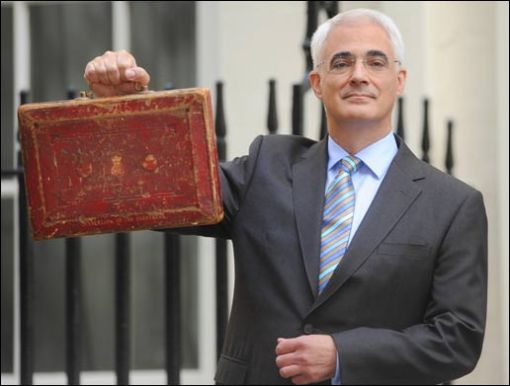

The increase in the rate of income tax for the high earners seems to be the most talked about topic of this year’s budget. The tax applies to all those who earn £150,000 or more. Add to that the National Insurance contribution and it equates to more than half of one’s salary. The aim of this rise, according to the chancellor Alistair Darling, is to contribute to the Treasury coffers to make up for the huge amounts of public sector borrowings, £175 billion this year itself.

The increase in the rate of income tax for the high earners seems to be the most talked about topic of this year’s budget. The tax applies to all those who earn £150,000 or more. Add to that the National Insurance contribution and it equates to more than half of one’s salary. The aim of this rise, according to the chancellor Alistair Darling, is to contribute to the Treasury coffers to make up for the huge amounts of public sector borrowings, £175 billion this year itself.

But it looks like the aim of this move is to gather support from the majority of the public who seem to hold all those who earn huge amounts of money responsible for all the mess that the economy is in. A poll by the Times newspaper shows that 57% of the respondents back this increase in tax. The accountancy and tax experts will definitely see a rise in business since they will have many clients asking them to look for loop holes allowing them to dodge the tax. And who will then pick up the bill? The hard working majority of course.

A lot of measures have been introduced in the budget to help people, like the scheme for the 18-25 year olds, £2000 car scrappage scheme, ISA allowance, etc. But its one thing to announce something and another thing to actually implement it.

Latest deals on lastminute.com

But, its not whats in the budget that’s important, but what wasn’t included in the budget. If the money coming in is less than the money going out, it may be OK to borrow money in the short term to cover that deficit. But somewhere along the line, cuts in spending will have to be made. There is no clear indication where those cuts will be made.

To make a start, how about the MPs themselves cutting back on the expenses that they claim from the tax payer. I mean claiming back 88p for a bath plug, how ridiculous is that. Its like almost mocking the tax payers. It is understandable that an MP from, say Newcastle, should be able to stay in London when performing his duties and expect the tax payer to pay for that. But that doesn’t mean buying a second home and pocketing the profit made from it. Its means lodging in a hotel during the stay. And if the MPs really care for the taxpayers, why not take a pay cut? Its not a lot to ask. Many workers have taken a pay cut in companies so that their colleagues can keep their jobs.

The Treasury estimates that it will spend £119 billion of the £671 billion on Health services this year. How about asking those who drink excessively and then take up the resources of the NHS when their bodies cant take it to pay for the service. How about allocating resources to curb rising obesity so that money doesn’t have to be spent on treating illnesses arising from it. Distributing garden tools and seeds across the schools would provide physical exercise and free produce as well.

People who currently receive help paying their fuel bills could be provided with subsidies allowing them to purchase energy efficient appliances such as electric kettles. This would reduce the energy used which would reduce the bills which would reduce the amount payed by the Government. Subsidies over 50% could also be provided to buy solar panels which would make homes thatreceive fuel allowance self sufficient which means that they wouldn’t be requiring the help from the Government.

There are many other ways that the money can be spent efficiently by the Government. Asking a group of over-paid Government consultants isn’t going to help, ask the public for ideas. I am sure that a lot of constructive ideas will emerge.

In hindsight, if the Government had spent their money wisely when it was coming in and saved for a rainy day, there might have been a bit of buffer that the Chancellor could have used. We instead ended up with no savings and a massive hurricane instead of a rainy day. The budget doesn’t seem to be based on sound economics, but on hope and a prayer. If the Chancellors own figures are to be believed from last year, we should be in a recovery sometime soon. But instead, we are still in a deep recession. Yet, he hopes the economy will grow by 3.5% in two years time. How? Manufacturing is affected despite the weak pound and the financial sector is not as big as it used to be. Who will then lead the recovery?

Even if the figures are somehow achieved, it is still better to plan for a slow growth and be pleasantly surprised by the massive growth than to plan/hope for massive growth and then get it spectacularly wrong.

Watching the candidates of The Apprentice talk about themselves misleads one into feeling that not only are they the best, but that they are the best of the best of the best when it comes to running a business and that Sir Alan Sugar should feel lucky that they are willing to work for him. Yet, when it comes to doing a task, they forget the most basic of business concepts.

Watching the candidates of The Apprentice talk about themselves misleads one into feeling that not only are they the best, but that they are the best of the best of the best when it comes to running a business and that Sir Alan Sugar should feel lucky that they are willing to work for him. Yet, when it comes to doing a task, they forget the most basic of business concepts. Ryanair, it seems, is very good at attracting negative publicity every time it comes up with a cost-cutting measure to “decrease the air fare for all its customers”. Its latest one is a plan to charge its passengers £1 for each time they want to use the in-flight toilet.

Ryanair, it seems, is very good at attracting negative publicity every time it comes up with a cost-cutting measure to “decrease the air fare for all its customers”. Its latest one is a plan to charge its passengers £1 for each time they want to use the in-flight toilet. The Department for the Environment, Food and Rural Affairs (Defra) has launched a “Sustainable Clothing Action Plan” co-inciding with the London Fashion Week to highlight the increasing problem of “fast fashion”. Apparently, UK consumers buy around two tonnes of clothes every year, and throw away a massive 1.2 million tonnes of them every year.

The Department for the Environment, Food and Rural Affairs (Defra) has launched a “Sustainable Clothing Action Plan” co-inciding with the London Fashion Week to highlight the increasing problem of “fast fashion”. Apparently, UK consumers buy around two tonnes of clothes every year, and throw away a massive 1.2 million tonnes of them every year.

The number of people unemployed is rising everyday due to firms going bankrupt or businesses making some of their staff redundant as part of a “cost-cutting measure”. However, the Chartered Institute of Personnel and Development (

The number of people unemployed is rising everyday due to firms going bankrupt or businesses making some of their staff redundant as part of a “cost-cutting measure”. However, the Chartered Institute of Personnel and Development ( The trading that occurs in the run up to Christmas is very crucial to retailers even in the “normal” years. It allows them to make up for the losses they might have incurred over the year and helps them prepare financially for the coming year. 2008 has been, by any standards, anything but a normal year. Huge banks have become small banks, some have been swallowed up by bigger banks, some have merged with other banks while some have disappeared altogether.

The trading that occurs in the run up to Christmas is very crucial to retailers even in the “normal” years. It allows them to make up for the losses they might have incurred over the year and helps them prepare financially for the coming year. 2008 has been, by any standards, anything but a normal year. Huge banks have become small banks, some have been swallowed up by bigger banks, some have merged with other banks while some have disappeared altogether.